Every month the UK Civil Aviation Authority releases its monthly statistics on UK airports and routes.

Every month I will break down the monthly statistics of Aberdeen, Edinburgh, Glasgow and Prestwick airports to try and provide some context to the information published.

At the end of every post I will also take a more detailed look at a country served from Scotland to try and understand any changes in travel patterns across the UK, as sometimes a basic year-on-year comparison does not go far enough.

The table below can be used to jump to a specific section if you would rather just read that part rather than the whole post.

- Scotland’s Main Airports Comparison

- Market Share Within Scotland

- Market Share Within the UK

- Country In Focus – Morocco

Scotland’s Main Airports Comparison

| Airport | 2024 | 2023 | % Change |

|---|---|---|---|

| ABZ | 169,354 | 158,504 | 6.8% |

| EDI | 1,153,317 | 1,066,685 | 8.1% |

| GLA | 546,225 | 513,234 | 6.4% |

| PIK | 24,951 | 20,749 | 20.3% |

All four of Scotland’s main airports recorded an increase in passenger numbers compared to December last year, with both Edinburgh and Prestwick recording monthly totals above 2019 levels.

It should be remembered that 2020 and 2021 were impacted by the pandemic.

Market Share Within Scotland

In the December 2024 Statistics, 16 airports in Scotland reported passenger numbers to the Civil Aviation Authority.

Between them these airports handled 1,950,590 passengers. Below is a breakdown of the percentage of the market each of these airports had in December 2024.

| Airport | 2024 | 2023 | % Change on 2023 |

|---|---|---|---|

| Aberdeen | 8.51% | 8.56% | -0.05% |

| Barra | 0.02% | 0.03% | -0.01% |

| Benbecula | 0.10% | 0.12% | -0.02% |

| Campbeltown | 0.02% | 0.02% | -0.00% |

| Dundee | 0.11% | 0.15% | -0.04% |

| Edinburgh | 57.96% | 57.60% | +0.36% |

| Glasgow | 27.45% | 27.71% | -0.26% |

| Inverness | 2.54% | 2.60% | -0.06% |

| Islay | 0.07% | 0.08% | -0.01% |

| Kirkwall | 0.51% | 0.53% | -0.02% |

| Lerwick | 0.01% | 0.00% | +0.01% |

| Prestwick | 1.25% | 1.12% | +0.13% |

| Stornoway | 0.37% | 0.43% | -0.06% |

| Sumburgh | 1.03% | 0.97% | +0.06% |

| Tiree | 0.02% | 0.03% | -0.01% |

| Wick | 0.51% | 0.53% | -0.02% |

The percentages in the table above may not add up to exactly 100% due to rounding!

Overall a very poor performance for most airports across Scotland, and, in what seems to be becoming a bit of a trend, Edinburgh and Prestwick both recorded increases while Aberdeen and Glasgow recorded a decrease in market share.

Given these statistics cover December, certain airports in the Highlands and Islands are more vulnerable to poor weather conditions causing flight cancellations, thus, data for these airports can be impacted by external forces.

Market Share Within the UK

When taking a holistic view of Scotland’s main airports performance across the UK, comparing their market share today with their market share pre-covid offers a valuable insight into their recovery.

As a group Aberdeen, Edinburgh, Glasgow and Prestwick have exceeded their total share of the UK market when compared to 2019, however, it is a relatively small increase of 0.04%.

Once again. the two AGS owned airports have reduced market share compared to pre-pandemic, compared to Edinburgh and Prestwick which have both exceeded their 2019 totals, with the former significantly ahead of its competition.

Country In Focus – Morocco

Every month I will take a country and perform a more detailed analysis of its performance from Scotland. For this month I have selected Morocco due to the significant increase in capacity from Scotland to both Agadir and Marrakesh.

Three airlines fly to Morocco from Scotland, each operating a combination of different routes and aircraft types;

- easyJet: Edinburgh to Agadir on the Airbus A320

- Ryanair: Edinburgh to Agadir on the Boeing 737-800

- Ryanair: Edinburgh to Marrakesh on the Boeing 737-800

- easyJet: Glasgow to Agadir on the Airbus A320

- easyJet: Glasgow to Marrakesh on the Airbus A320

- Jet2: Glasgow to Agadir on the Boeing 737-800

- Jet2: Glasgow to Marrakesh on the Boeing 737-800

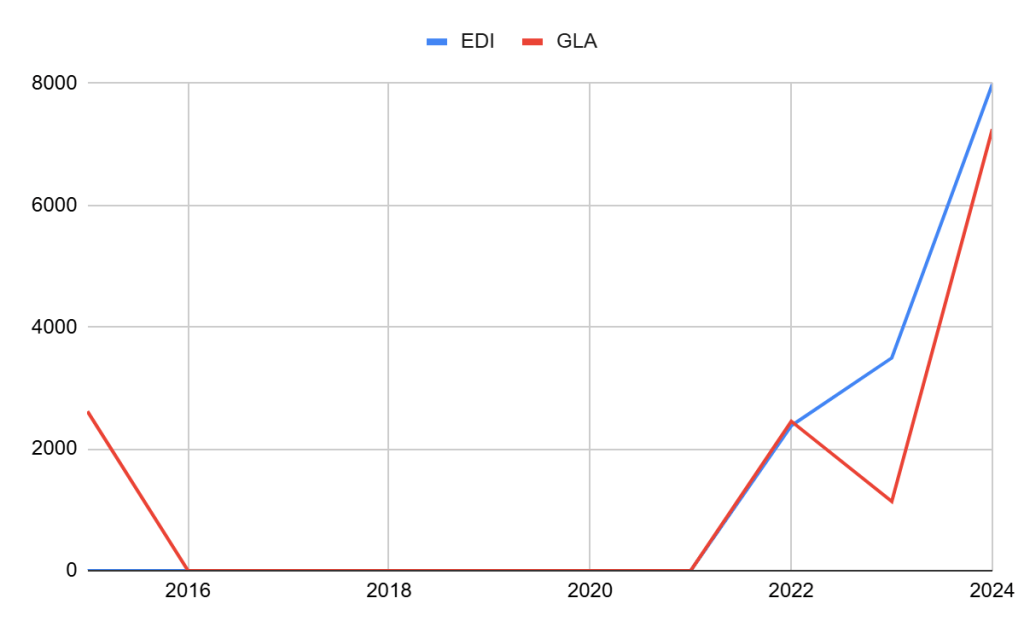

Passenger numbers from 2015 are included in the table below,

| Year | Edinburgh | Glasgow |

|---|---|---|

| 2015 | 0 | 2,616 |

| 2016 | 0 | 0 |

| 2017 | 0 | 0 |

| 2018 | 0 | 0 |

| 2019 | 0 | 0 |

| 2020 | 0 | 0 |

| 2021 | 0 | 0 |

| 2022 | 2,380 | 2,453 |

| 2023 | 3,493 | 1,136 |

| 2024 | 7,987 | 7,250 |

The above data is shown in graph form below for a better visual representation.

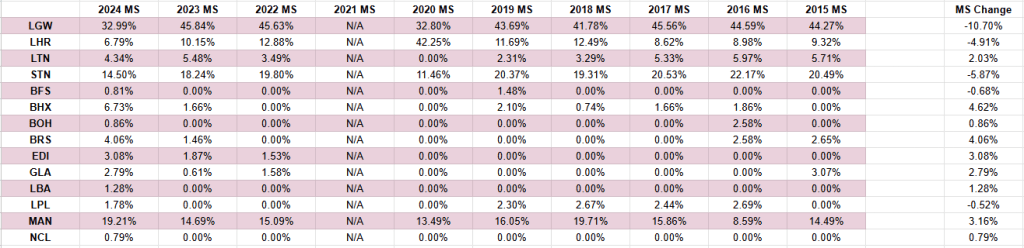

For the next set of information I will be referencing the table of data below which looks at every UK airport that has had service to Morocco since 2015.

Before I continue, it is worth highlighting at this stage the significant rise in passengers between the UK and Morocco since last year, with many airports seeing multiple new routes to both Agadir and Marrakesh.

Using the monthly total for passengers between the UK and Morocco the monthly market share for each airport is included in the table below;

Looking across the UK, based on December 2024 data there were 14 airports with service to Morocco, a significant increase from the 8 that were served in 2019.

Doing a comparison with 2019, outside of the airports who have lost their service, London Gatwick has seen the biggest fall in market share, reducing by 10.7%, Heathrow and Stansted have also witnessed reductions in their market share, with Luton being the only London airport to record an increase.

London Gatwick retains the largest share of the market, with 32.99% , with Luton being the smallest of the 4 London airports.

Jumping over to Northern Ireland, Belfast International has a smaller portion of the market than it did in 2019, however, it remains the only airport in Northern Ireland with Morocco flights, with passengers also having the choice to fly from Dublin, Ireland.

In Scotland, neither Edinburgh nor Glasgow had services in 2019 to draw a comparison with, however, when compared to last year, Glasgow had the largest jump in market share, recording an 2.18% increase on December 2023, compared to 1.21% in Edinburgh, thanks largely to Marrakesh jumping from 0 to 4 weekly flights.

Edinburgh’s market share was larger at 3.08%, compared to Glasgow at 2.79%.

In England (excluding London), all airports apart from Liverpool recorded an increase in their market share (LPL reduced by 0.52% to 1.78%), compared to neighbouring Manchester which increased by 3.16% to 19.21%

The largest increase in market share across the UK was Birmingham, with an increase of 4.62%, taking its total share of the Morocco market to 6.73%.

Enjoying My Content?

If you are enjoying my content and would like to support me then I have included a donation link below, you can also share this post on social media!

About The Author

George Nugent is an independent travel writer focused on honest reviews of rail, air, and coach journeys in the UK, Europe, and USA. Passionate about statistics and clear reporting, George shares insights to help travellers make informed choices.