Introduction

Sunday March 30th marked the start of the IATA Summer Season across the UK, with airports and airlines gearing up for the busiest time of the year. One such airport group doing just that is AGS who own and operate Aberdeen. Glasgow and Southampton Airports.

Having just been taken over by AviAlliance and Blackstone there has rightfully been a lot of talk about the group, with many, including myself, finding all three airports lagging behind in terms of its competitors – primarily Edinburgh and Bournemouth.

This post is primarily intended to put all my thoughts, and the thoughts of others into one place, providing an overview of what customers of AGS feel has let the group down, and crucially what they would like to see differently.

I will state now that due to location bias, this post will primarily focus on Glasgow Airport, but where possible I will reference the other airports in the group.

The list of topics I will cover in this post can be found below, so use the list provided to jump to a specific section if you would like;

- Introduction

- AGS Airports Overview

- Issues Out with AGS’s Control That Impact Them

- Public Transport at Glasgow Airport

- Airline Choice and Route Network

- Terminal Appearances

- My Final Thoughts

AGS Airports Overview

AGS Airports was founded in 2014 as a joint venture between Ferrovial and Macquarie following the sale of Aberdeen, Glasgow and Southampton Airports by BAA, with the group committing to improving connectivity across the regions they serve.

This structure remained in place until January 2025, when AviAlliance, a subsidiary of the Canadian pension fund PSP Investments acquired the group for £1.53 billion, with the company taking over full control of AGS Airports.

In March 2025 it was announced that Blackstone would acquire a 22% stake in AGS in a deal worth £235 million, AviAlliance would remain the majority shareholder with 78%

Aberdeen Airport

Located in the North East of Scotland, Aberdeen Airport is the second largest by passenger numbers in the AGS portfolio, and is one of two airports located in Scotland.

Home to 12 airlines serving 31 destinations across the UK and Europe, it remains the third busiest airport in Scotland, handling 2,300,657 passengers in 2024, an increase of 3% on the previous year.

Passenger numbers at Aberdeen Airport remain below 2019 levels, with the airport only operating at 79% of pre-pandemic totals, and with no significant growth in passenger numbers forecast for summer 2025, it remains increasingly unlikely that ABZ will recover the remaining 21% anytime soon.

Glasgow Airport

Glasgow Airport is the largest, and busiest, airport in the AGS Group and is the other airport located in Scotland, specifically to the West of Glasgow City Centre.

Home to 15 airlines (14 in 2025 as Balkan Holidays will now use Jet2.com services) serving 91 destinations across Africa, Asia, Europe, North America and the UK, it remains the second busiest airport in Scotland, handling 8,067,685 passengers in 2024, an increase of 10% on the previous year.

Passenger numbers at Glasgow Airport remain below 2019 levels, with the airport operating at 91.2% of pre-pandemic totals. It looks unlikely based on current seats available for 2025 that the airport will exceed 2019 levels, with 2026 looking like the earliest possible opportunity to do so.

Southampton Airport

Southampton Airport is the smallest airport in the AGS Group and is located on the South Coast of England. While being the smallest and quietest airport in the group, it is also the most restrained airport thanks to its short runway (more on that later), and its location.

Host to 7 airlines serving 16 destinations across the UK and Europe the airport handled 852,727 passengers in 2024, an increase of 13% on the year before.

Passenger numbers at Southampton Airport remain below 2019 levels, with the airport only operating at 47.8% of pre-pandemic totals, and with no significant growth in passenger numbers forecast for summer 2025, it remains increasingly unlikely that SOU will recover the remaining traffic soon, however, there is more to this issue which will be talked about further in this post.

Issues Out with AGS’s Control That Impact Them

While it is easy to point all of the blame at AGS, there are some factors directly impacting the group that are out with their control, however, could still be the subject of valid questioning.

Air Baltic Engine Issues

Air Baltic’s Riga to Aberdeen route has been cancelled for 2025 as a result of several Airbus A220-300 aircraft remaining grounded due to issues with their Pratt & Whitney Engines.

The Riga-Aberdeen route is one of 19 being cancelled by the airline, alongside 21 being reduced. These engine issues are out with both AGS’s control and the airlines control, however, Air Baltic has obviously made the decision using data that we will never see, remember “high load factors ≠ a successful route”.

Ryanair Boeing Delivery Delays

Due to well documented delays with the delivery of new Boeing 737-8-200 aircraft from Boeing, Ryanair has been forced to scale back its growth plans for Summer 2025.

I have no idea what Ryanair originally had planned for AGS owned airports, and they are growing at both Aberdeen and Glasgow, however, it is worth keeping in mind that flights from bases across Europe that could be destined for Aberdeen or Glasgow may have been either delayed or cancelled as a result of these issues.

WIZZ Air Engine Issues

Similar to Air Baltic, WIZZ Air has been forced to ground a number of its aircraft until its Pratt and Whitney Engines can be inspected, resulting in the cancellation of a number of routes, and reductions on others.

For AGS, the airlines’ Bucharest-Glasgow route has been dropped, and growth on it’s Gdansk-Aberdeen route has been restrained as a result of the airline managing these issues.

Despite this, the airline has launched a number of new routes for this summer, so it would be fair to ask why Glasgow and Aberdeen have suffered at the expense of other airports.

With these issues impacting primarily Aberdeen and Glasgow Airports and being largely outside the control of AGS, I now want to pivot this story into issues that they do have significantly more control over.

I want to make it clear, none of these points are being made without evidence to back up the point I am making. I am also writing this in as constructive a tone as possible, avoiding unnecessary criticism that doesn’t really matter, while also avoiding drawing consistent comparisons to other airports unless it is necessary.

Public Transport at Glasgow Airport

My own view, public transport at Glasgow Airport is woeful, and that is putting it nicely. It’s network doesn’t cover enough of the airports catchment area, and the services that do exist are either too infrequent or too expensive, or depending on the time of day…both.

When I was researching this article I searched for the latest “Surface Access Strategy” published by either Glasgow Airport or AGS. To my surprise, the most recent copy I could find was published in 2009 by BAA covering the 2009-2013 period.

This surprised me, after all, BAA no longer exists and AGS has owned the airport since 2014, yet it appears there is not an updated strategy to be found.

Although this is not ideal, it does provide an opportunity to see if BAA were successful in doing what they set out to achieve, or does the public transport issue stretch much further back than AGS?

Objective 1: To increase the percentage of passengers using public transport from 8.5% to 12% by 2006

Verdict: Fail

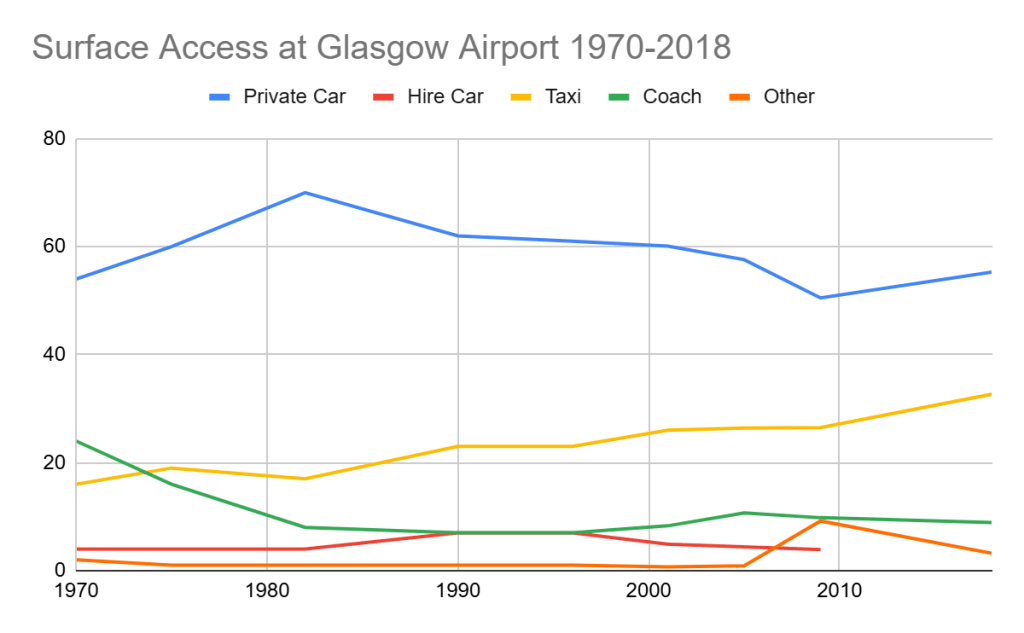

Looking at data from the Civil Aviation Authority who publish a yearly survey of departing passengers it appears this goal was not met.

In 2005 10.7% of passengers surveyed indicated they arrived at Glasgow Airport using either Bus or Coach, with private car being the largest source.

In 2009, the same survey indicated 9.8% arrived by either bus or coach, with private car once again being the largest.

In 2013, the options presented by the CAA changed to just “public” or “private”, with Glasgow Airport recording 13.9% in the public category, above the 12% target, just 7 years later than planned.

Fast forward again to 2018, the options once again changed, with Bus/Coach returning as an option as did Rail. Glasgow Airport recorded 11.6% of passengers using either Bus/Coach (8.9%) or Rail (2.7%).

The question asked in 2018 did change to “MAIN” mode used, hence why rail recorded a score.

When data is collated all the way back to 1970, it clearly shows that not only has public transport usage roughly remained stable in recent years, it actually has fallen significantly since 1970 as public access to private vehicles changed and public transport ownership changed sectors.

Public Transport Network

The public transport network at an airport should ideally serve large population areas of its catchment area, and provide a fast, frequent and affordable service to make it as appealing as possible.

In 2011, the following bus services called at Glasgow Airport

- First 500: Airport to City Centre

- Arriva 500: Airport to City Centre

- Arriva 800: Airport to Largs via Johnstone, Beith and Kilbirnie

- Arriva 300: Paisley to Clydebank via Glasgow Airport and Erskine

- Arriva 66: Airport to Dykebar via Paisley

- First 747: Airport to City Centre via Renfrew, Braehead & the West End.

- Scottish CityLink 915: Glasgow to Skye via Glasgow Airport, Loch Lomond, Glencoe and Fort William

I should point out before listing the current transport links that Arriva was sold to McGill’s buses in 2012.

Today, the current bus network from Glasgow Airport is as follows;

- Ember: Glasgow to Fort William via Dumbarton, Balloch, Loch Lomond and Glencoe

- First Bus 500: Airport to City Centre

- First Bus 77: Airport to City Centre via Renfrew, Braehead & the West End

- McGill’s 757: Paisley to Clydebank via Glasgow Airport & Erskine

- Flixbus: Glasgow Airport to Aberdeen via Stirling, Perth & Dundee

- Scottish CityLink 915: Glasgow to Skye via Glasgow Airport, Loch Lomond, Glencoe and Fort William

- Scottish CityLink 926: Glasgow to Campbeltown via Glasgow Airport, Loch Lomond, Inveraray & Kennacraig

- Scottish CityLink 977: Glasgow to Oban via Loch Lomond, Tyndrum, Dalmally & Taynuilt

Interestingly, the longer distance network of services has improved, with more areas served, and crucially, areas with connections to CalMac ferries to the Islands featuring on the destination lists, yet local bus services have all but disappeared.

Areas such as Johnstone and Dykebar which are less than five miles from Glasgow Airport are now unserved, with passengers now having to travel via Paisley on two buses rather than direct, and even the service to Paisley is less frequent than it was.

When you introduce the need for a change in a journey to the airport it makes the car more appealing, or worse for Glasgow Airport, makes airports such as Prestwick, Edinburgh and Manchester more appealing as they can all be reached with a single change as well.

There are two specific areas of the existing network I would like to highlight.

- 757 Evening Service Levels

In the evening the 757 service between the airport and Paisley is supposed to run every hour, providing a link between the airport and local bus services in Paisley and crucially, rail services from Gilmour Street station.

The area highlighted in the red box is what I want to talk about, that gap of 77 minutes creates a significant access barrier, primarily for passengers arriving at Glasgow Airport and wanting to reach their final destination.

Assuming 30 minutes to exit the airport after arriving, which has been my average across a range of flights with some including picking up bags, then below gives an idea as to how many potential passengers arrive in this service blackspot;

| Flight Number | Origin | Arrival Time | Potential Passenger Load |

|---|---|---|---|

| LM428 | Islay | 1905 | 42 |

| EZY412 | London Stansted | 1915 | 186 |

| FR2608 | Malaga | 1920 | 197 |

| BA8728 | London City | 1925 | 106 |

| EI3622 | Belfast City | 1930 | 72 |

| EJU5509 | Alicante | 1935 | 156 |

| EZY871 | London Gatwick | 1940 | 186 |

| EI3228 | Dublin | 1940 | 72 |

| 1,017 |

Assuming the most recent CAA Survey data from 2018 is correct that would mean 11.6% of those passengers continuing their journey by bus.

11.6% of 1017 = 117.9 (we will round to 118)

Given there are three bus routes at this time, with one being the “flagship” service to the city we will allocate that 50% weighting, with the 77 and the 757 sharing the rest equally.

First Bus 500 = 59 passengers

First Bus 77 = 29.5 passengers (lets call it 30)

McGill’s 757 = 29 passengers

This is a massive simplification and application of data to a Monday night at Glasgow Airport, but it should help show the point I am trying to illustrate.

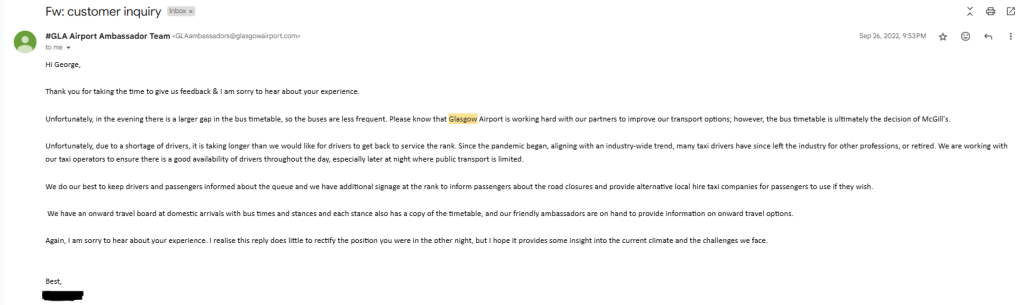

I raised this issue to Glasgow Airport using the contact form on their website back in September 2022 after I arrived from Belfast City and fell victim to this trap. As it was summer, and not raining, I made the decision to walk into Paisley from the airport, however, in the rain, or winter, or with bags this walk is not recommended, leaving passengers either significantly extending their journey or paying for a taxi.

Below is the response I received (note: I have blurred out the ambassadors name as none of this was his fault, he can only say what he has been told)

Since September 2022 the issue with the 757 timetable still exists, and the airport has added more than 1.5 million passengers to its yearly total.

The airport has worked with First Bus to introduce more 500 services, in the evening, going from every hour to every 15 minutes, but the next section covers my issue with this service.

The real punch for Glasgow Airport, if you land at the start of this service blackspot, you may as well fly to Edinburgh as it’s just as fast;

- Land at Edinburgh Airport at 1900

- Exit Edinburgh Airport at 1930

- Board an AIR Service to Glasgow at 1955 arriving into Glasgow at 2049

- Board the 2115 ScotRail service to Ardrossan Harbour at Glasgow Central arriving at 2205

- Board an AIR Service to Glasgow at 1955 arriving into Glasgow at 2049

- Exit Edinburgh Airport at 1930

OR

- Land at Glasgow Airport at 1900

- Exit Glasgow Airport at 1930

- Board the 2045 McGill’s service to Paisley arriving at 2057

- Board the 2125 ScotRail service to Ardrossan Harbour at Paisley Gilmour Street arriving at 2205

- Board the 2045 McGill’s service to Paisley arriving at 2057

- Exit Glasgow Airport at 1930

It is possible to do that journey from Glasgow Airport much faster than that by going into the city on the 500 bus, but this takes me nicely to my second issue I would like to highlight.

2. First Bus 500 Ticket Prices

Ticket prices on this service are disproportionately high compared to the level of service provided.

I have covered this topic a couple of times before so won’t repeat myself, however, it is worth highlighting again that my own research shows that Glasgow Airport has the most expensive “City to Airport” service of the UK’s Top 10 Airports.

| One Way Price (On The Day Price) | Approx Price Per Mile | |

|---|---|---|

| London Heathrow | £13.90 (Elizabeth Line) | 70.6 pence per mile |

| London Gatwick | £15.10 (Thameslink) | 53.6 pence per mile |

| Manchester | £6.70 (anytime train) | 64.9 pence per mile |

| London Stansted | £25 (Stansted Express) | 69.4 pence per mile |

| London Luton | £24.10 (East Midlands Railway) | 77.49 pence per mile |

| Edinburgh | £4.50 (Brightbus) | 56 pence per mile |

| Birmingham | £3.50 (West Midlands Railway) | 43.75 pence per mile |

| Bristol | £9 (Bristol Airport Flyer) | 91 pence per mile |

| Glasgow | £11 (Glasgow Airport Express) | 113.4 pence per mile |

| Belfast International | £9 (Translink Service 300) | 48.6 pence per mile |

Read More: Glasgow Airport Express – The Big Purple Tourist Trap

If Glasgow Airport wants to make itself an attractive option to potential passengers in the city it serves, surface access costs are a good first step to look at.

Consider the following points;

- Are passengers paying extra for the ability to use their ticket on a connecting bus service in the city?

- If so, should there be a cheaper ticket without that option?

- A single to Glasgow Airport is £11 for a journey of just under 10 miles.

- A single to Edinburgh Airport from the same starting point is £16.60 for a journey of 40 miles.

Although it is cheaper to get from Glasgow City Centre to Glasgow Airport, the perception of value is the biggest detractor for potential passengers. In a price sensitive world, paying an extra £5.60 for a single to Edinburgh Airport comes across much better value than going to GLA.

Is Surface Access Actually Important?

In one word – yes

Edinburgh Airport currently has 36.6% of passengers using public transport to or from its terminal as of 2023, and has recently published an ambitious “Surface Access Strategy” on how to further increase this figure.

More passengers use public transport to access Edinburgh Airport than any other UK airport – excluding those with direct rail links.

Edinburgh Airport Surface Access Strategy

By having transport links to a wide range of towns and cities across Scotland, Edinburgh Airport has used public transport to its advantage by making it as easy as possible to access the airport regardless of where you are.

By having a bus link to Glasgow with their logo on it, even if somebody in Glasgow is doing something as trivial as going to Tesco (other supermarkets are available) they are still being exposed to the EDI brand, something GLA could learn a lot from.

13% of passengers at Edinburgh Airport in 2023 came from postcodes in Glasgow & Dunbartonshire (that’s 2,051,090 passengers!), improving local surface access to Glasgow Airport, and improvements to airline and route networks would allow some of those passengers to fly from Glasgow Airport, freeing more capacity at Edinburgh at the same time for other passengers.

Even in Glasgow itself, areas such as the Hydro and SEC remain unserved despite being of significant importance to the international reputation of the city, connecting these destinations to the airport would be an ideal first step to improving connectivity. There is an online petition to introduce a bus route from Giffnock, Thornliebank, Netherlee, Clarkston, Busby and Newton Mearns to Glasgow Airport, working to connect these areas directly to GLA would be a significant step forward.

Furthermore, working with ScotRail and local bus operators to reintroduce rail/bus tickets utilising Paisley Gilmour Street and Partick (for the 77) would also be an excellent addition to the existing public transport portfolio.

Airline Choice and Route Network

This section was possibly the hardest to write as I really was not sure what direction I wanted to take it. I have decided to highlight questions a lot of people have raised and my thoughts on the current route network.

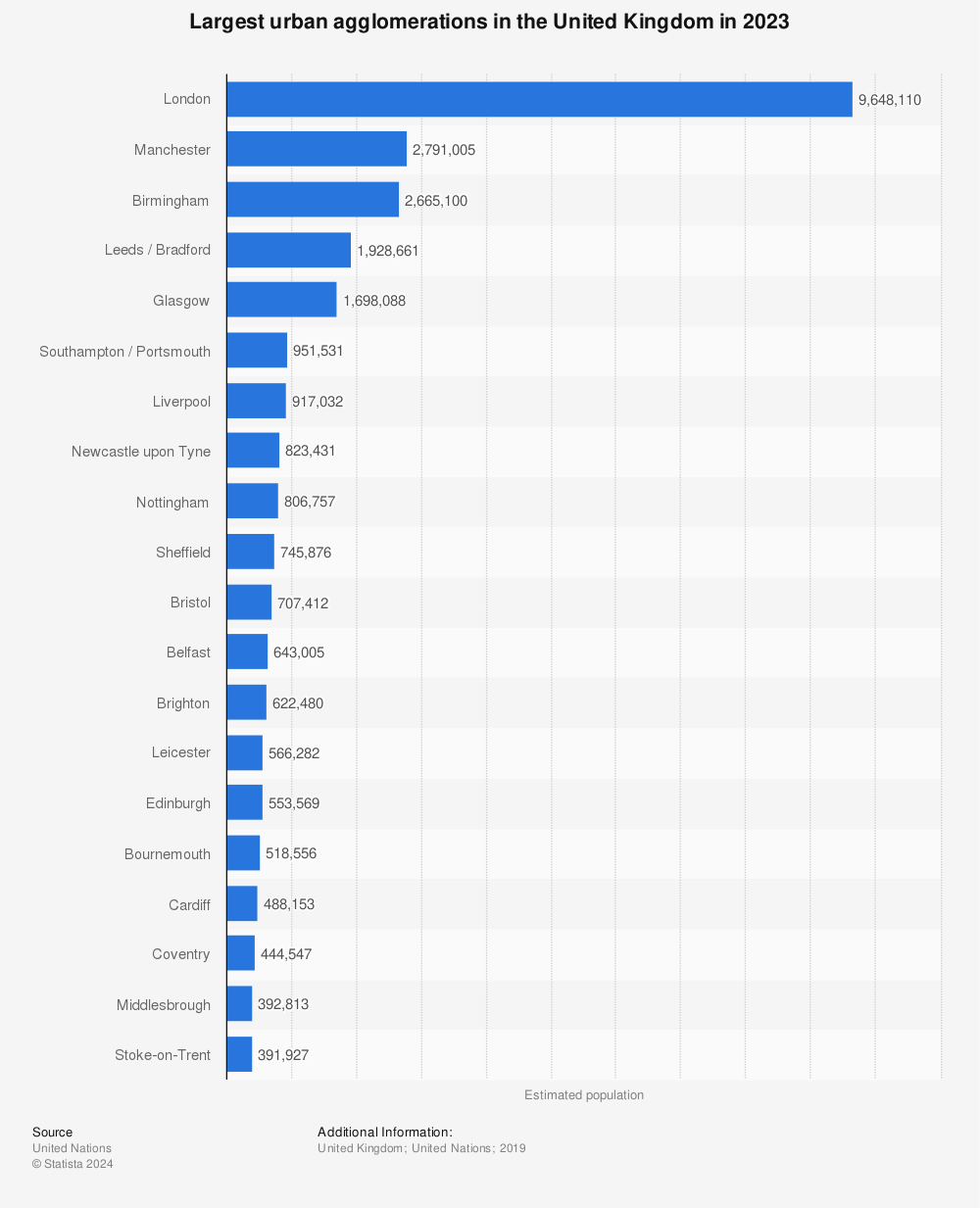

Glasgow is one of the largest urban agglomerations in the UK (for those unaware an urban agglomeration is a large, contiguous urban area consisting of a city and its surrounding suburban or thickly settled areas).

The advantage for AGS is two of their three airports are in the top 10, with Southampton and Portsmouth being the sixth largest. This should place both airports in a good position for growth due to the large number of potential customers in the areas they serve.

Find more statistics at Statista

Looking at the current portfolio of airlines at Glasgow Airport, it appears to be remaining stagnant, hovering around the 15 mark since 2022.

Since the pandemic airlines such as PLAY, Transavia & Vueling have all launched and subsequently cut services at Glasgow Airport, with others such as Corendon and WIZZ reducing routes and services by 50% since starting in 2022 and 2023 respectively.

Looking ahead to summer 2025, one new airline joins the airport portfolio in the form of SunExpress to Antalya and Dalaman. While welcoming a new airline is always welcomed, unfortunately they are flying to two destinations already well served by other airlines. SunExpress becomes the fifth carrier to announce flights to Antalya and the fourth to Dalaman – great, but not everybody wants to go to Turkiye.

The most notable new routes for AGS this summer come in the form of Ryanair launching Malta-Glasgow and Krakow-Aberdeen – why? – These are the airlines first new routes to AGS owned airports since 2018 and take the number of routes operated by Ryanair at Glasgow to 7 and Aberdeen to 4.

To put those figures into context, here is the number of Ryanair destinations from each UK airport;

- London Stansted – 165

- Manchester – 85

- Edinburgh – 66

- Birmingham – 49

- Bristol – 37

- East Midlands – 33

- Liverpool – 32

- London Luton – 31

- Leeds Bradford – 24

- Bournemouth – 21

- Belfast International – 20

- Newcastle – 18

- Glasgow Prestwick – 10

- Glasgow – 7

- Newquay – 6

- Teesside – 5

- Cardiff – 5

- Aberdeen – 4

- Exeter – 4

- London Gatwick – 4

- Norwich – 3

- City of Derry – 1

While welcoming a 7th Ryanair route to Glasgow Airport is to be welcomed, it only takes the airport back to where it was in 2023 when Warsaw Modlin operated (this route was dropped due to a dispute between Modlin airport and Ryanair).

Looking elsewhere, easyJet also announced two “new routes” this summer to Antalya and Reus – as already mentioned Antalya now has 5 airlines and Reus now has 3. On the surface this is fine, but the airline dropped flights to Lisbon, Newquay and Marseille, leaving two of those destinations now unserved from Glasgow.

The former AGS CEO Andy Cliffe also made a number of quotes during his tenure which, when you consider that the success rate of these statements is currently sitting at 0%, has done nothing but further harm AGS’s reputation;

“WizzAir returned their operation to Glasgow in the autumn of last year. We expect them to build from that position.”

Focusing specifically on the second sentence, below is the number of seats and movements by WIZZ Air at Glasgow Airport in Summer 2024 vs Summer 2025.

| S24 | S25 | |

|---|---|---|

| Movements | 198 | 120 |

| Seats | 45,540 | 28,680 |

As noted earlier, WIZZ Air is suffering ongoing fleet issues, but the airline is still launching new routes from Bucharest while Glasgow remains dropped from the OTP network since June 2024.

WIZZ Air will add two new routes from Glasgow Airport in October in the form of Milan and Rome, but will remove it’s Budapest route at the same time.

“North America remains absolutely a target. We are very hopeful we will start to return those services to Glasgow as well.”

Not wanting to repeat myself, but American tourists numbers to Scotland keep increasing year-on-year yet there is still no US service from Glasgow apart from TUI.

In the time since that comment was made, American Airlines and JetBlue announced flights to Scotland from Edinburgh which raises the question, is it now too late from GLA to secure a new US route?

“…we absolutely see another opportunity for in excess of another one million passengers added this year.”

I’ll let the passenger numbers do the talking here and allow you to decide if this was met;

- 2024 – 8,067,685

- 2023 – 7,358,828

- Passengers added = 708,857

I can’t sit here and blame Andy Cliffe entirely for what he said, after all it was his job to promote Glasgow Airport, but currently none of what he said to a national media outlet has happened, and that is what people will judge AGS by, undelivered claim after undelivered claim after undelivered claim.

It is refreshing to see the new AGS CEO (Kam Jandu) has not made the same mistakes by over promising claims, and I hope he is able to lead AGS towards achieving these targets.

Updating Online Information

Having an up-to-date website is a fantastic way to highlight your successes, share route information and answer people questions before they travel.

From a layout perspective, the AGS Group airports websites are actually very nice, information is easy to find and it gets the mix between information and adverts right in my opinion.

Taking a deeper look into the route and destination information on each website however does reveal some issues, they aren’t end of the world issues, nobody is going to lose sleep over them, but fixing them would only enhance the user experience, not detract from it.

I took the time to go through the destinations page for each airport and have listed the issues for each of them below;

For Aberdeen Airport I found the following issues on the page linked here, and filtering by each individual airline.

| Airline | Destinations to Add | Destinations to Remove |

|---|---|---|

| Aer Lingus | Dublin | – |

| Balkan Holidays | Burgas | – |

| British Airways | London Heathrow | – |

| Eastern Airways | Teesside | – |

| easyJet | Geneva London Gatwick London Luton | – |

| KLM | Amsterdam | – |

| Loganair | Manchester | Teesside |

| Ryanair | Alicante Faro Malaga | – |

| SAS | Copenhagen Stavanger | – |

| Wideroe | Bergen Stavanger | – |

| WIZZ Air | Gdansk | – |

For Glasgow Airport I found the following issues on the page linked here, and filtering by each individual airline.

| Airline | Destinations to Add | Destinations to Remove |

|---|---|---|

| Aer Lingus | Belfast City | – |

| British Airways | London Gatwick | – |

| easyJet | Bordeaux Chania Hurghada Reus Southampton | Krakow |

| Jet2 | Berlin Budapest Krakow | – |

| Loganair | – | Southampton |

| Lufthansa | – | Munich |

| Ryanair | Malta | – |

| TUI | La Romana Sal Toulouse | Burgas Fuerteventura Heraklion Larnaca Montego Bay |

On a more general note, the list of airlines that passengers can use to filter destinations by is missing Icelandair.

For Southampton Airport I found the following issues on the page linked here and by filtering by each individual airline.

| Airline | Destinations to Add | Destinations to Remove |

|---|---|---|

| Aer Lingus | Belfast City Dublin | |

| Aurigny | Alderney Guernsey | |

| British Airways | Alicante Faro Majorca | |

| easyJet | Belfast International Geneva Glasgow Majorca | |

| Loganair | Edinburgh Newcastle | |

| TUI | Majorca |

The recent introduction of the option to filter destinations is a welcomed step and makes it easier for people to see where their favourite airline flies, and updating the information to be as accurate as possible would only enhance the usability, there is no downside to it.

Other small updates such as removing “We fly to more than 100 destinations” from the destinations map, as well as adding the missing destinations to it would also make a positive enhancement, allowing these pages to be shared as part of social media posts on a regular basis.

Terminal Appearances

I don’t want to spend too much time on this section so I will keep it brief. I am struggling to think of any significant investments in the Glasgow Airport terminal since AGS was formed.

The only projects I can think of its the works carried out to support the Emirates A380, a welcomed step as it allowed Emirates to increase capacity to Dubai as well as creating an additional stand for narrow body aircraft, and the ongoing work in security (which isn’t optional, GLA had no choice but to comply with the law).

There are parts of the GLA terminal which look severely outdated, with the East Pier of the airport looking particularly run down in areas. I can look past some of this, but in my opinion the biggest issue is having carpet everywhere in departures. Carpet in a high traffic building with people dragging cases just leads me to one question – when was it last deep cleaned?

By contrast, AGS has invested in Southampton with the recently opened runway extension allowing easyJet to significantly expand their operations at the airport.

The advantage Glasgow has is its terminal is actually well laid out all things considered from a passenger perspective, just improving the physical appearance would go a long way. I do also have to give some credit to the retail team at AGS, they have been opening new outlets at Glasgow relatively consistently, creating another revenue stream for the airport.

Seeing money spent on vanity projects such as Valet Parking and Priority Passport Control while several jet bridges were out of service for example didn’t create the best impression, and I hope that the same level of effort spent on these projects can be replicated elsewhere.

My Final Thoughts

I didn’t write this piece as a pile on to AGS Airports, I mainly wanted to highlight what I felt were some really small changes to existing elements that I think would significantly improve the customer experience if they were improved.

It also wasn’t written to pit two airports against each other, it was more to highlight that certain other airports have been able to use elements such as public transport to their advantage to support growth, and that it would be worth considering the same at Glasgow Airport.

As a regular user of Glasgow Airport I want to make something clear, the frontline staff you see every day are one of the airports biggest assets, from check-in to security and from duty-free to lounge staff, all the vast majority of the staff I have encountered in my travels have only added to the experience.

Since AviAlliance acquired the group and appointed a new CEO it has been refreshing to see the change in communications between AGS owned airports and customers on platforms such as LinkedIn, and hopefully the days of press releases promoting routes from Edinburgh are behind us!

Some Posts That Might Be Relevant

Market Overview: Scotland to Ireland

Market Overview: Scotland to China

Market Overview: Scotland to Canada

Market Overview: Scotland to Italy

Market Overview: Scotland to Switzerland

About The Author

George Nugent is an independent travel writer focused on honest reviews of rail, air, and coach journeys in the UK, Europe, and USA. Passionate about statistics and clear reporting, George shares insights to help travellers make informed choices.